By Matt Rama, Chief Commercial Officer, TMNZ

Rather than waiting for an unexpected audit, businesses should proactively review their tax compliance. Voluntary disclosure can lead to reduced or even waived penalties, while failure to comply can result in severe financial and legal consequences. Shortfall penalties range from 20% for minor mistakes to 150% for tax evasion. Serious offences could even lead to imprisonment. Consulting a tax advisor and coming forward early can save your business from hefty penalties.

Post-COVID, IRD is targeting not only struggling businesses but also “zombie companies” that survived on government assistance without maintaining proper tax practices. Liquidation cases initiated by IRD have surged 56%, rising from 549 in 2024 to 849 in 2025. For unsustainable businesses, early liquidation is often the best course of action to minimise damage to stakeholders.

Tax pooling services like TMNZ can provide some relief for companies that act quickly. IRD’s retrospective reassessments sometimes reach as far back as 2010 but TMNZ can help mitigate penalties by purchasing backdated tax at a lower cost. However, tax pool availability for years more than a decade ago is limited, making early action essential.

Areas of focus: Payroll Tax, GST, and NRWT

IRD is cracking down on payroll tax and GST compliance, emphasizing that these are ‘pass-through’ taxes businesses are not entitled to retain. Non-Resident Withholding Tax (NRWT) is also under scrutiny, with IRD identifying significant underreporting. Legislative changes now allow businesses to retrospectively register for ‘Approved Issuer Levy,’ offering lower tax rates for interest payments to offshore lenders.

To avoid penalties, businesses should:

- Conduct a comprehensive tax compliance review.

- Consult with a tax advisor.

- Make a voluntary disclosure if necessary.

Being proactive with tax compliance not only prevents financial and legal troubles but also demonstrates good faith to authorities. Stay ahead of IRD’s crackdown – review your tax obligations today.

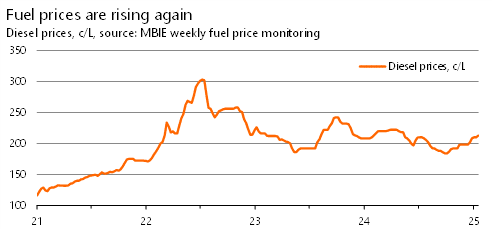

Secondly, the NZ dollar has fallen by about seven cents against its US counterpart since early October, adding another 12% (or about 11c/L) to the imported cost of fuel. The currency has been at its lowest level in 27 months, and within touching distance of dropping below US55c for the first time since 2009.

The exchange rate’s story is primarily one of US dollar strength rather than NZ dollar weakness. Donald Trump’s re-election as President has seen financial markets betting on faster US economic growth this year due to more stimulatory policies being introduced. Concerns about lingering inflation in the US have also reduced the likely scope for the Federal Reserve to cut interest rates. These two factors combined have attracted investment funds to the US and pushed the greenback higher.

Where do fuel prices go throughout the rest of this year? Uncertainty around the international geopolitical situation is much more heightened than normal, due to the Ukraine conflict, US threats of significant tariffs and trade sanctions, and the general unpredictability of President Trump. Over the course of this year, though, perhaps the President’s most telling policy will be his desire to increase oil production in the US. Oil price spikes could occur for any number of reasons in the next few months, but international oil prices are expected to be back down at the end of this year to late-2024 levels.

International oil price trends are only part of the story for New Zealand businesses and households. In terms of the exchange rate, the good news is that further significant declines seem unlikely. Although an official cash rate of 3.25% by mid-2025 still seems on the cards, financial markets are starting to scale back their expectations of further Reserve Bank cuts given the emergence of more price pressures internationally. Investor support for the NZ dollar should also be generated by stronger meat and dairy export prices, along with the economy’s emergence from last year’s recession.

Taking these factors together, we expect to see a little more upward pressure on NZ fuel prices over the next couple of months. Although some moderation in international oil prices should provide some relief from mid-2025, the weaker NZ dollar compared to last year, is likely to keep diesel prices above $2.10/L throughout the rest of this year.