Gareth Kiernan, Chief Forecaster, Infometrics.

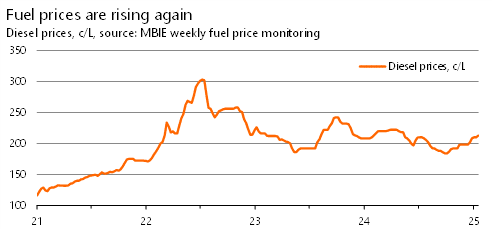

Diesel prices drifted downwards throughout much of 2024, by September reaching their lowest level since Russia invaded Ukraine in early 2022. But the relief for transport operators has been short-lived, with a renewed lift of almost 30c/L since early October. The upward pressure on fuel costs in New Zealand has been twofold.

International oil prices have risen by about US$11/bl since mid-November. Much of this rise has reflected additional US sanctions on Russia that were imposed by President Biden before he left office, as the G7 aims to reduce Russian export revenue from energy. Every US$10/bl increase in international oil prices adds about 20c/L to pump prices in New Zealand.

Secondly, the NZ dollar has fallen by about seven cents against its US counterpart since early October, adding another 12% (or about 11c/L) to the imported cost of fuel. The currency has been at its lowest level in 27 months, and within touching distance of dropping below US55c for the first time since 2009.

The exchange rate’s story is primarily one of US dollar strength rather than NZ dollar weakness. Donald Trump’s re-election as President has seen financial markets betting on faster US economic growth this year due to more stimulatory policies being introduced. Concerns about lingering inflation in the US have also reduced the likely scope for the Federal Reserve to cut interest rates. These two factors combined have attracted investment funds to the US and pushed the greenback higher.

Where do fuel prices go throughout the rest of this year? Uncertainty around the international geopolitical situation is much more heightened than normal, due to the Ukraine conflict, US threats of significant tariffs and trade sanctions, and the general unpredictability of President Trump. Over the course of this year, though, perhaps the President’s most telling policy will be his desire to increase oil production in the US. Oil price spikes could occur for any number of reasons in the next few months, but international oil prices are expected to be back down at the end of this year to late-2024 levels.

International oil price trends are only part of the story for New Zealand businesses and households. In terms of the exchange rate, the good news is that further significant declines seem unlikely. Although an official cash rate of 3.25% by mid-2025 still seems on the cards, financial markets are starting to scale back their expectations of further Reserve Bank cuts given the emergence of more price pressures internationally. Investor support for the NZ dollar should also be generated by stronger meat and dairy export prices, along with the economy’s emergence from last year’s recession.

Taking these factors together, we expect to see a little more upward pressure on NZ fuel prices over the next couple of months. Although some moderation in international oil prices should provide some relief from mid-2025, the weaker NZ dollar compared to last year, is likely to keep diesel prices above $2.10/L throughout the rest of this year.